Comprehensive Insurance Strategies for Your Business

Running a business involves managing numerous risks, from unforeseen accidents to potential legal disputes. One of the most effective ways to safeguard your company’s assets, operations, and employees is through comprehensive insurance coverage. Insurance helps mitigate financial losses that could otherwise cripple your business. Whether you’re just starting or looking to refine your existing insurance strategies, ensuring every part of your company is covered is a critical component of long-term stability. This article will explore key types of insurance every business should consider, including a focus on shipping protection for those involved in e-commerce.

Understanding General Liability Insurance

General liability insurance is one of the foundational coverage types for any business. It protects your company against a wide range of claims, such as bodily injury, property damage, or personal injury resulting from your business activities. If a customer or vendor slips and falls on your property, or if a product you sold causes damage or harm, general liability insurance can cover legal fees, medical expenses, and any compensation awarded in a lawsuit.

This type of insurance is especially vital for businesses that interact directly with the public or have a physical presence, such as retail stores or service-based companies. Without general liability insurance, your company could be exposed to significant financial risks from accidents or negligence claims that could potentially put you out of business.

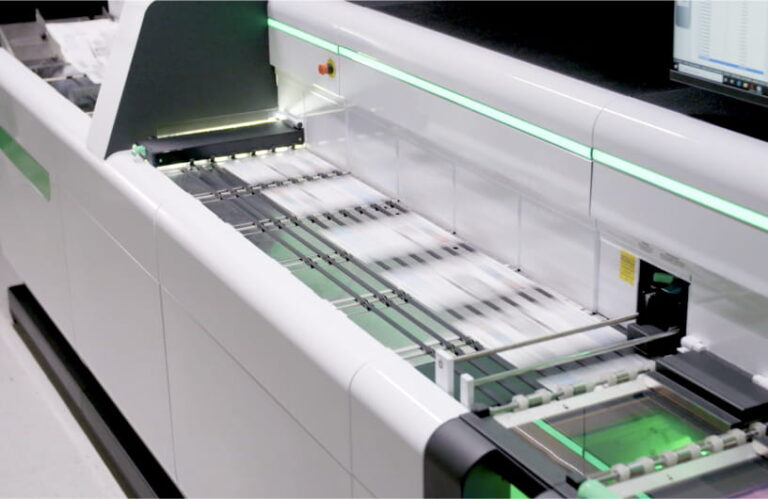

Shipping Insurance and Protection

For businesses that ship goods, especially those in e-commerce, shipping insurance plays an important role in reducing risk. One critical question many business owners face is, is shipping protection worth it? Shipping protection, or shipping insurance, provides coverage in the event that items are lost, damaged, or stolen during transit. While many shipping carriers offer standard coverage, it may not be sufficient for high-value or fragile items.

Investing in shipping insurance is often worth it, as it helps protect your company’s financial interests and ensures customer satisfaction. If you sell expensive or delicate products, shipping insurance ensures that the cost of replacing or refunding a damaged item doesn’t fall solely on your business. Additionally, offering insurance to customers can improve their confidence in your service, knowing that their purchases are protected during delivery.

Cyber Liability Insurance

In today’s digital world, businesses are increasingly vulnerable to cyber threats, including data breaches, hacking, and identity theft. Cyber liability insurance is designed to protect businesses in the event of a data breach or cyberattack. This insurance can cover costs related to data recovery, legal fees, customer notifications, and any damage to your company’s reputation.

With an increasing number of businesses storing sensitive customer information online, such as payment details and personal data, cyber liability insurance has become a critical component for many companies. In the event of a breach, this coverage can provide essential financial support and help mitigate the long-term damage to your brand’s reputation.

READ MORE : The Impact of Local vs. Imported Foods on Sustainability

Commercial Auto Insurance

If your business uses vehicles to transport goods, make deliveries, or visit clients, commercial auto insurance is necessary. This coverage protects your company in the event of an accident involving company-owned or leased vehicles. Commercial auto insurance covers liability, property damage, and medical expenses resulting from accidents while driving for business purposes.

This insurance is important for businesses in delivery services, construction, transportation, and any other field that requires the use of vehicles for business operations. Commercial auto insurance can prevent significant out-of-pocket expenses in the event of an accident, protecting both your vehicles and your drivers.

Conclusion

Insuring every part of your company is essential for managing risk and ensuring business continuity. From general liability and property insurance to workers’ compensation, shipping insurance, and cyber liability, comprehensive coverage provides a safety net against unforeseen events that could otherwise harm your business. By evaluating your company’s unique risks and securing the appropriate insurance, you are taking a proactive approach to safeguard your assets, employees, and reputation. This not only helps minimize potential financial losses but also strengthens the foundation of your business for long-term growth and success.